In an era of shifting economic gravity, global capital is seeking fresh horizons. As traditional investment hubs face headwinds, investors are looking to dynamic emerging economies for growth, innovation, and sustainable returns. This article explores the forces driving the pivot to emerging markets, highlights sectoral opportunities, addresses challenges, and offers practical guidance for stakeholders aiming to harness this transformative trend.

Recent data underscores a significant reconfiguration of foreign direct investment. In 2024, global FDI flows fell by 11%, marking the second consecutive year of decline. Following a slight dip in 2023 to $1.3 trillion—2% below the previous year—developing economies received just $435 billion, the lowest amount since 2005. Although a 4% uptick in 2024 was reported, it largely reflected volatile financial conduit flows rather than genuine productive investment.

Developed economies, particularly across Europe, experienced sharp downturns in investment, while emerging regions demonstrated resilience. Least developed countries attracted $31 billion in 2023, yet FDI remains highly concentrated in a handful of recipients, underscoring the uneven nature of the current landscape.

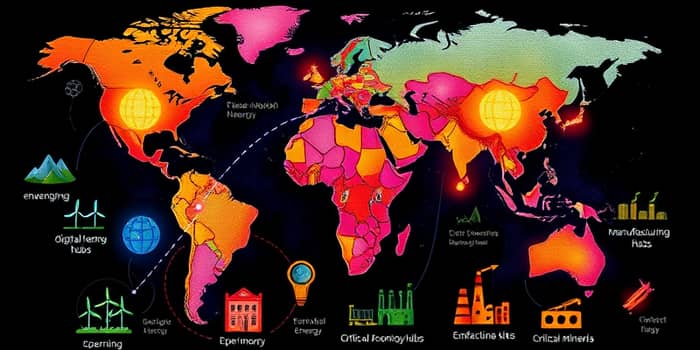

Emerging markets are capturing investor attention thanks to demographic dynamism, technological leapfrogging, and abundant natural resources. In Southeast Asia, Africa, and India, rapid mobile internet adoption and fintech expansion have enabled a burst of digital transformation.

Projects in e-commerce, mobile banking, and digital infrastructure are thriving, creating robust digital transformation in emerging markets. These regions also offer critical minerals and resource availability, essential for global energy transitions. Strategic proximity to major markets, coupled with supply chain realignments, further elevates their appeal.

The recalibration of global value chains has redirected manufacturing investments to emerging regions. Automotive, electronics, and machinery sectors are thriving as companies diversify supply bases. Meanwhile, renewable energy and green technologies have attracted unprecedented interest. Investments in green hydrogen, renewable power plants, and sustainable infrastructure are on the rise.

Although digital economy financing has cooled since the 2022 boom, projections for 2025 indicate renewed acceleration. However, evolving FDI screening processes in Ireland, Singapore, and Canada highlight emerging regulatory complexities that investors must navigate carefully.

Despite the promise, investors and policymakers must confront several hurdles. In 2025, nearly half of the FDI-related measures announced in developing economies were restrictive, marking the highest level since 2010. Countries like Canada have introduced mandatory pre-closing filings and extended review periods, signaling strategic shift towards sustainable energy sectors oversight intensification. Geopolitical fragmentation and US-China trade tensions complicate cross-border decisions, while supply chain realignments require constant recalibration. Financing gaps, especially in infrastructure and technology, highlight a heavy reliance on scarce international project funding. Moreover, the concentration of FDI in a handful of emerging markets can expose both investors and host countries to uneven risks, emphasizing the need for diversification and robust risk management frameworks.

To sustain this FDI pivot, emerging countries must undertake bold domestic reforms and investment treaties. Streamlining administrative procedures, enhancing transparency, and strengthening legal frameworks can significantly bolster investor confidence. Historically, bilateral investment treaties have lifted FDI flows by over 40%, yet their pace of conclusion has slowed since the 1990s.

Aligning capital inflows with the United Nations Sustainable Development Goals is equally vital. Governments should incentivize projects that generate employment, foster inclusive growth, and support align investment with sustainable development goals. Collaborative platforms, such as the upcoming Financing for Development conferences, offer avenues to mobilize public and private resources effectively.

By mid-century, the Indo-Pacific region, parts of Africa, and Latin America are expected to command more than half of global economic output. Their burgeoning middle classes, youthful demographics, and urbanization trajectories will continue to fuel demand across sectors, from consumer goods to high-tech industries.

For investors and stakeholders seeking to navigate this evolving terrain, here are key practical steps:

Embracing the shift towards emerging economies entails both opportunity and responsibility. By adopting a long-term perspective, fostering local partnerships, and integrating environmental, social, and governance criteria, investors can help catalyze a virtuous cycle of growth that benefits both capital providers and host communities. The pivot of FDI to emerging markets is more than a financial trend—it is a profound reimagining of the global investment landscape, one that holds the promise of sustainable prosperity for the decades ahead.

References