We are on the cusp of a dramatic transformation in how we work, driven by economic shifts, technological leaps, and demographic tides.

This evolution presents a landscape of both daunting challenges and unprecedented opportunities for growth, requiring adaptability from all stakeholders.

Understanding these dynamics is essential for navigating the new normal and thriving in the years ahead.

Global economies are experiencing a recalibration, with labor markets entering a phase of normalization.

In the UK, weak growth persists, and unemployment may rise, reinforcing a sense of stagnation.

Meanwhile, the U.S. sees measured job creation, but structural shifts are undeniable.

Key projections highlight the scale of change.

These indicators suggest a workforce in flux, with reorganizing rather than shrinking as a central theme.

Investment decisions must account for this volatility and the broader economic context.

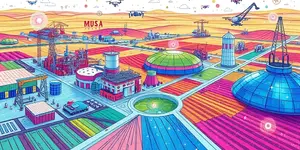

Amid the turbulence, certain sectors are poised for explosive growth, driven by societal needs and innovation.

Healthcare and social assistance, for instance, are set to expand rapidly due to aging populations.

Green energy roles, like wind turbine technicians, are among the fastest-growing jobs nationwide.

Skilled trades and advanced manufacturing are evolving with automation, not disappearing.

Technology and data-driven work remain in high demand across various industries.

The table below summarizes key areas for focus.

These sectors offer resilience and growth, making them prime targets for strategic investment.

Embracing these areas can lead to substantial returns and societal benefit.

Artificial intelligence is reshaping work at an unprecedented pace, with far-reaching implications.

AI adoption is likely irreversible, fueling both efficiency gains and significant disruptions.

About 60% of jobs in advanced economies are AI-exposed, meaning tasks can be augmented or replaced.

This shift demands a new focus on skills and adaptability.

The skills shift is intensifying, with alignment with emerging opportunities becoming critical for workers.

Investors should look to companies that leverage AI for augmentation rather than mere replacement.

Demographic pressures are creating a mismatch between a shrinking workforce and growing retirement needs.

Low fertility rates and migration trends are reducing the working-age population in many regions.

This necessitates innovative policy responses and investment angles to sustain economic vitality.

Addressing these issues requires collaboration between governments, businesses, and individuals.

Investment in training and flexible work models can mitigate demographic challenges.

The pandemic accelerated a shift toward flexible work arrangements, now a dominant feature of modern workplaces.

Hybrid working is accepted as the future operating model, valued highly by employees.

Over half of remote-capable employees prefer hybrid setups, sometimes sacrificing pay for flexibility.

This trend has profound implications for gender equality and productivity.

Adapting to these preferences is key for attracting and retaining talent.

Beyond immediate trends, deeper structural issues like jobless expansion and inequality require attention.

Evidence of firms doing more with less highlights efficiency gains but also potential job losses.

Structural inequality is widening between regions and skill levels, posing social risks.

Questions about managing fewer jobs in the future are emerging, echoing historical shifts.

Regulatory landscapes, including AI ethics and employment laws, add complexity to the mix.

For investors, this means focusing on sectors that promote inclusivity and sustainable growth.

Opportunities lie in education tech, green infrastructure, and AI ethics consulting.

The future of work is not a distant concept but a present reality unfolding before us.

By understanding economic indicators, leveraging high-growth sectors, and adapting to technological changes, we can turn challenges into victories.

Interpretation of macro signals is crucial for making informed decisions in this complex environment.

Embrace lifelong learning, invest in resilient industries, and advocate for policies that support workforce transition.

Together, we can build a more equitable and prosperous future for all.

References