Imagine a world where a distant conflict can ripple through your investment portfolio, turning uncertainty into tangible financial returns. This is the reality of commodity futures, where geopolitical risk is not just a background noise but a significant pricing factor that demands attention.

Research reveals that commodities with high exposure to geopolitical turmoil generate 7.92% higher annual returns than their low-risk counterparts, a stark reminder that investors seek compensation for navigating volatile landscapes.

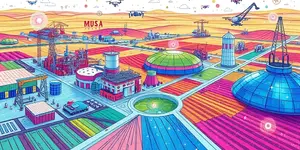

This article will guide you through the intricate dance between global politics and market prices, providing practical insights to inspire smarter decisions in an era defined by unpredictability.

The relationship between geopolitical risk and commodity futures is structured around a predictable risk premium.

Investors demand extra compensation when faced with uncertainties like wars or trade tensions, creating a measurable premium that fluctuates over time.

By recognizing these patterns, you can anticipate market movements and position yourself advantageously.

Not all commodities respond equally to geopolitical shocks. Understanding sector-specific vulnerabilities is key to effective portfolio management.

This table summarizes the impact across major commodity categories, based on empirical findings:

This knowledge empowers you to diversify strategically, balancing risk across sectors.

Geopolitical events influence commodity prices through multiple channels, each offering a lens to decode market behavior.

Supply chain disruptions are a primary driver. Events like wars or sanctions can profoundly disrupt supply chain stability, leading to immediate price spikes.

For instance, Russia's invasion of Ukraine in 2022 caused wheat and oil prices to surge due to blocked supply routes, illustrating this mechanism vividly.

Market information processing seals the effect, as participants anticipate sustained supply drops, fueling further buying.

Geopolitical risk is not uniform; it emanates from specific regions and nations that shape global commodity dynamics.

Analysis identifies US, Germany, India, and Russia as key drivers of risk spillovers, with their political actions reverberating across borders.

By monitoring these hotspots, you can stay ahead of market shifts and adjust your strategies accordingly.

The relationship between geopolitics and commodities has evolved over time, influenced by broader economic trends.

Since the early 2000s, the impact has strengthened, driven by the financialization process altering commodity futures relationships with geopolitical risk.

In recent years, up to early 2025, diplomatic efforts have eased some premiums, but ongoing tensions ensure that risk remains a constant factor.

Adapting to these changes can transform volatility from a threat into an opportunity for growth.

To harness geopolitical risk, one must understand how it's measured and modeled in financial research.

Studies use tools like the Geopolitical Risk Index (GPRH), which captures wars, terrorism, and international tensions over long periods.

This index provides a robust framework for analyzing volatility, outperforming alternatives by offering consistent historical data.

These methodologies offer a scientific basis for making informed investment decisions, reducing guesswork.

For investors, the interplay of geopolitics and commodities is not just theoretical; it's a practical tool for enhancing portfolio performance.

Commodities are reclaiming their role as crucial hedges and portfolio diversifiers amid persistent geopolitical and inflationary pressures.

By integrating these strategies, you can build resilience and tap into the attractive returns commodities offer in 2026.

Looking ahead, the commodity markets will continue to be shaped by geopolitical undercurrents, requiring vigilance and adaptability.

As geopolitics and global trade patterns rapidly reconfigure, businesses and investors must stay informed of key shifts to thrive.

Potential areas like Iranian unpredictability or new conflicts could replace current risks, maintaining ongoing premiums.

This perspective transforms market participation into a journey of understanding our world, inspiring confidence in uncertain times. By mastering the interplay of geopolitics and commodity futures, you unlock a powerful lens to navigate complexity, turning global events into pathways for prosperity and growth.

References