In the fast-paced world of financial markets, success hinges not just on charts and numbers, but on the human mind. Trading success is 85% psychology, a statistic that underscores the profound impact of emotional control on profitability. This article aims to unravel the complex interplay between emotions and trading, offering insights and strategies to master your inner world for sustainable gains.

The journey begins with a paradox: emotions are neither wholly good nor bad. Their effects depend entirely on context and personal regulation. By understanding this, traders can transform volatility into opportunity and uncertainty into confidence.

Emotional mastery is not about suppressing feelings but managing them effectively. It requires dedication, practice, and a deep sense of self-awareness. Let us explore the psychological foundations that shape every trade you make.

At the core of trading psychology lie primary emotions that drive decision-making. Fear and greed are the most notorious, but anxiety, overconfidence, and frustration play equally critical roles. Recognizing these emotions is the first step toward control.

Fear manifests in various ways, from hesitation to premature exits. It often stems from fear of loss or missing out, leading to missed opportunities and reduced position sizes. Greed, on the other hand, pushes traders to overleverage and hold positions too long.

These emotions do not operate in isolation. They interact with market conditions to amplify their effects. For instance, sharp price drops can spark panic selling, while rapid upward moves induce FOMO buying.

Beyond raw emotions, cognitive biases distort perception and judgment. Loss aversion and confirmation bias are particularly pervasive. Loss aversion causes traders to hold losing positions, hoping for recovery rather than cutting losses early.

Confirmation bias leads traders to seek information that supports existing beliefs. This can blind them to warning signs and critical market data. Overcoming these biases requires objective review and constant self-reflection.

These pitfalls often emerge unconsciously, impacting trading behavior in subtle ways. Regular journaling can help identify and mitigate their influence over time.

Emotions directly affect trading outcomes by altering risk perception and reaction times. Anxiety, for example, delays entry points, causing traders to miss optimal market conditions. Overconfidence increases position sizes beyond rational risk tolerance.

Research shows that anticipatory emotion is context-dependent. In certain market patterns, higher anticipatory emotion improves returns, while in others, it leads to risk aversion and losses. The relationship between emotion and performance is nuanced.

Experienced traders do not suppress emotions but regulate them effectively. They turn felt emotions into positive strategies, demonstrating that emotional awareness is key to long-term success.

External factors often activate emotional responses, creating cycles of fear and greed. Understanding these triggers can help traders prepare and maintain composure.

By anticipating these conditions, traders can implement pre-emptive strategies. This involves setting daily loss limits and following systematic rules to avoid impulsive decisions.

Mastering emotions requires a multifaceted approach. Structured planning, journaling, mental techniques, and objective support form the foundation of effective emotion management.

Structured planning involves establishing predefined entry and exit points. This reduces emotional interference during trades. Systematic entry and exit rules are essential for consistency and discipline.

Journaling enhances self-awareness by recording emotional states. Document pre-trade emotions and post-trade reflections to identify patterns over time.

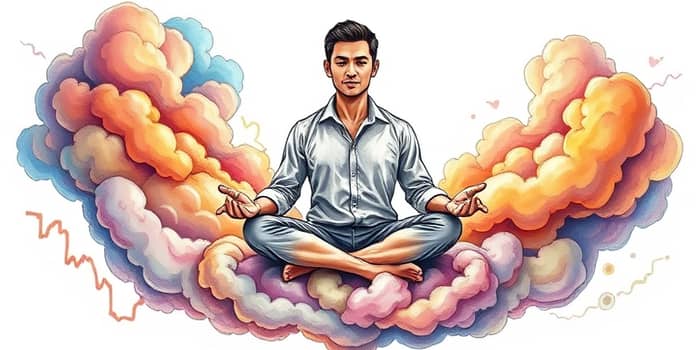

Mental and physical techniques include mindfulness practices and regular breaks. These help traders stay grounded and reduce stress during volatile periods.

Objective review through tracking win-loss ratios and seeking mentorship maintains clarity. A coach or mentor can provide neutral feedback, preventing emotional biases from clouding judgment.

Beyond basic emotions, anticipatory versus reactive emotions play a crucial role. Anticipatory emotion, felt before a trade, can be beneficial or detrimental based on market context. Context-dependent emotion regulation is key to optimizing decisions.

Research indicates that emotion regulation strategies should minimize variability. For example, maintaining high arousal during downward trends and controlled low arousal during upward trends can enhance performance.

Experienced traders leverage their emotional responses to inform strategies. They do not switch off emotion but harness it through disciplined practice and continuous learning.

Emotional mastery in trading is not a destination but a continuous journey. It involves cultivating awareness, discipline, patience, and adaptability. By implementing the strategies outlined here, traders can build resilience and turn psychological challenges into advantages.

Remember, the greatest edge in trading resides in the mind. Through systematic learning and self-reflection, you can transform fear into caution and greed into calculated ambition. Start today by journaling your emotions and setting clear trading rules.

Embrace the process, and watch as your profits grow alongside your emotional intelligence. The market may be unpredictable, but your response to it can be consistently profitable.

References